- Background: U.S.–China Trade Tensions

- Origins: In 2018 the U.S. imposed tariffs on roughly \$250 billion of Chinese imports; China retaliated on \$110 billion of U.S. goods.

- Chemical Sector Focus: Key U.S. tariffs target intermediate chemicals (e.g., methanol, acetic acid) and specialty polymers; China’s retaliatory duties cover petrochemicals, dyes, and additives.

- Recent Developments (Q1 2025)

- U.S. Adjustment: In March 2025, the U.S. temporarily exempted certain chemical intermediates (e.g., ethylene glycol, propylene oxide) from 25 % duties for six months to ease domestic shortages.

- China Response: Beijing lowered import duties on select pharma APIs (e.g., ciprofloxacin, azithromycin) to stabilize local supply and reduce costs.

- Tariff War Effects on Global Trade

| Category | U.S. Duties on China | China Duties on U.S. | Impact on Others (India) Demand shifts to Indian supplier - India’s Competitive Advantage

- Duty‑Free Access

- Under various U.S. GSP (Generalized System of Preferences) programs, over 75 % of India’s chemical exports enter duty‑free.

- Cost‑Effective Production

- Indian manufacturers benefit from lower feedstock costs (e.g., naphtha, coal‑tar derivatives) and economies of scale in petrochemicals and dyes.

- Regulatory Alignment

- India’s recent alignment of pharma API standards with U.S. FDA and EU EDQM guidelines simplifies market entry.

- Diversified Sourcing

- Buyers in the U.S. and EU are reducing reliance on China, opening long‑term contracts for Indian suppliers of:

- Acetic acid, ethylene oxide,SLS/SLES surfactants

- Ciprofloxacin HCl, Ibuprofen intermediates

- Reactive dyes, optical brighteners, UV absorbers.

- Case Study: Shifting Supply of Ethylene Oxide

- Pre‑Tariff (2021–22): U.S. imported ~45 % of its ethylene oxide from China.

- Post‑Tariff (2024): Chinese shipments fell by 60 %; Indian exporters increased volumes by 150 %, capturing 25 % of U.S. market share.

- Outcome:

- U.S. buyers saved an average 8 % on landed costs by switching to India.

- Indian producers ramped capacity by 20 % and invested $100 million in new reactors.

- Strategic Recommendations for Indian Exporters

- Product Diversification: Develop niche specialty chemicals (e.g., bio‑based surfactants, green solvents) to meet shifting demand.

- Trade‑Finance Solutions: Partner with banks to provide letters of credit and flexible payment terms to importers adjusting to tariff volatility.

- Tariff Timeline: Chart showing U.S. and China tariff hikes since 2018.

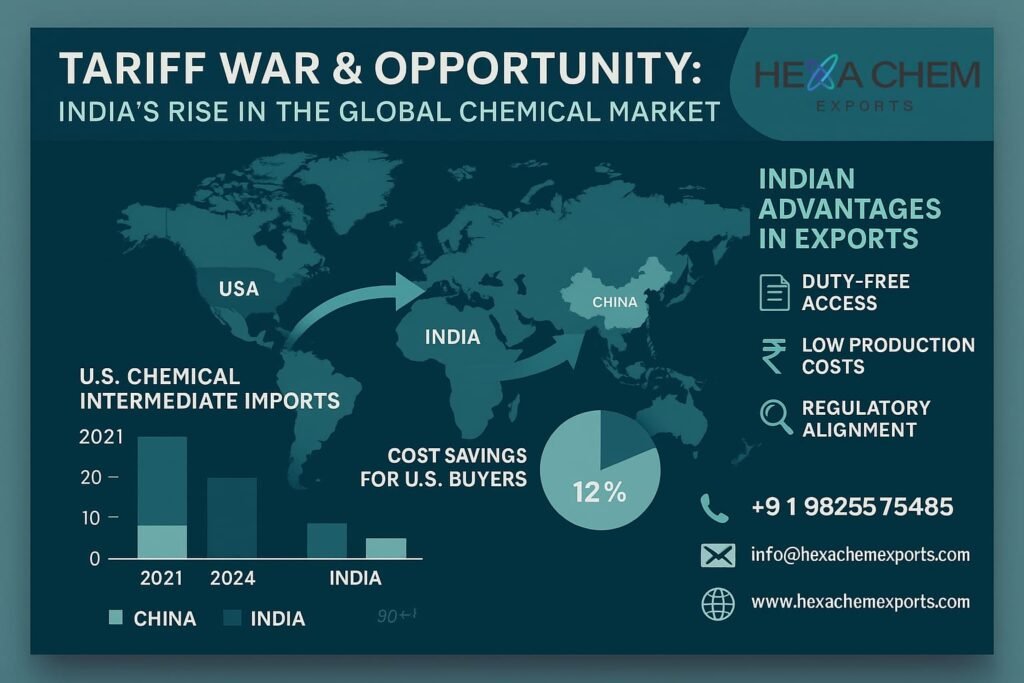

- Market‑Share Shift: Bar graph comparing China vs. India exports of key intermediates to the U.S. (2021 vs. 2024).

- Cost‑Savings Analysis: Pie chart of landed‑cost reduction (%) for U.S. buyers switching to India.

HexaChemExports is your trusted partner for high‑quality chemical and pharma intermediates.

📧 info@hexachemexports.com | 📞 +91 98255 75485

🌐 www.hexachemexports.com